Further to my observations in my earlier blog :

http://lalitlk-lalit-lk.blogspot.in/2012/06/nifty-inversion-of-waves-over-2-years.html

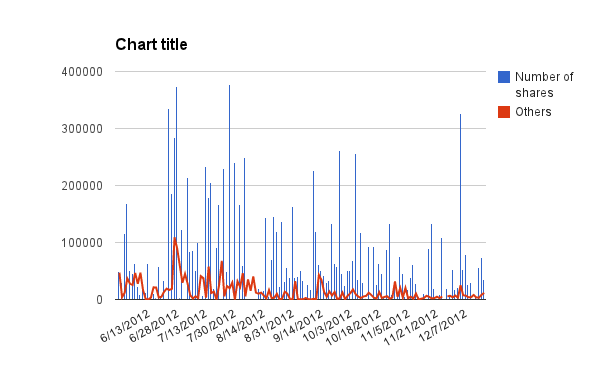

I shall like to review the Nifty Chart over the last three years which is :

Image from the chart January 2010 to 05/08/11 was,as per attachment

I went back by one year and similarly inverted that chart from January 2009 & resulted charted was labelled H & thereafter the boxed area is YET TO PLAY OUT. If the hypothesis comes TRUE, it has so far done PATTERN WISE, Nifty is due for a DIP in recent time & then scale NEW HIGH.

Let us cross our fingers to check if these hypothesis comes true or not.

http://lalitlk-lalit-lk.blogspot.in/2012/06/nifty-inversion-of-waves-over-2-years.html

I shall like to review the Nifty Chart over the last three years which is :

Image from the chart January 2010 to 05/08/11 was,as per attachment

was inverted 180 degree( anti-clockwise) and the 'Inverted Chart' is being shown along with Chart for the period of 05/08/2011 to year end in the following chart with prominent 'pattern similarity' marked A to H.

Chart beyond H, in the inverted one, is yet to play out & looks favoring the bears.I went back by one year and similarly inverted that chart from January 2009 & resulted charted was labelled H & thereafter the boxed area is YET TO PLAY OUT. If the hypothesis comes TRUE, it has so far done PATTERN WISE, Nifty is due for a DIP in recent time & then scale NEW HIGH.