Had introduced the 'step sum' in my earlier blog :

http://lalitlk-lalit-lk.blogspot.in/2015/12/nifty-1995-2015-step-sum-analysis.html

“15 Count” is running sum of the daily step used in constructing their

step sum over consecutive 15 days. Gold’s 15 count reached a

few 10s and 11s over the past five decades but never higher. Then last

November during the selling panic in the gold market it declined to a 13 for

the first time ever.

Silver’s November bottom

was even harder; its 15 count declined to -15.

In other words the price of silver fell below its previous closing price every

day for three trading weeks. That had never happened before, although just a

few months before silver’s January 1980 market top we saw its 15 count reach +15 in September 1979, according to Mark Lundeen.

“Count +/- 13” means 14 up (down) & 1 Down(up),

“Count

+/- 11” means 13 up (down) & 2 Down(up),

“Count +/-

9” means 12 up (down) & 3 Down(up),

And so on

“Count +/-

1” means 8 up (down) & 7 Down(up). I had examined the history of Nifty Index since 3rd November 1995 (the day from which OHLC is being compiled by NSE). My findings are shared as below :-

Out of 244 months (during 20 years 4 months), Nifty Step Sum Count_15 most were in the range of + 9 to - 9 as per Chart :

Out of 244 months (during 20 years 4 months), Nifty Step Sum Count_15 most were in the range of + 9 to - 9 as per Chart :

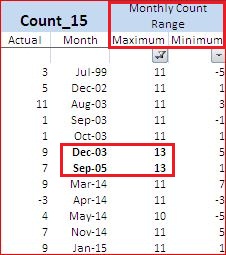

However, there were just 2 occasions of "13" count as StepUp

& just 5 occasions of "11" counts as StepDown

& finally Step Sum Chart for Nifty (Monthly) over 20 years 4 months :