Further to introduction in my blog

http://lalitlk-lalit-lk.blogspot.in/2015/12/nifty-1995-2015-step-sum-analysis.html

Step Sum is in the form of a new technical tool to

evaluate the psychology of the market. It has been developed by Mark Lundeen

and it offers a unique insight into the psychology of the market.The step sum is a single

item Advance – Decline Line. In other words; if Nifty is down from the

previous day’s close, we give it a value of (-1), if they end the day up

from the previous day’s close, we give it a value of (+1). So a step sum

plot is merely the net sum of up and down market days over time.

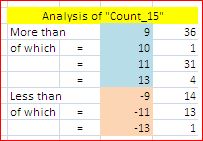

15 day running sum of the

daily steps used in constructing their step sums may be called “Count 15” A “Count +/-

15” means All 15 either Up or Down days in continuation

We are yet to see “count

15” in Nifty , examined over 5076 days. Even counts exceeding “9” are just

a few as displayed below :

, just 50 in total – literally just 1% of the total.

For a meaning full

understanding of vast Data, a suitable filter was used. A number of positive

“Count 15” – specially one after another - score up the step sum & a number

of negative “Count 15” – specially one after another – drag down the step sum.

A close examination of Chart is suggested for better understanding.

Three Table incorporating Step Sum Count_15

exceeding 9 is being given :

Next Chart covering Nifty 2001-16 shows Step Sum with Nifty closing ; upper portion tries to depict the influence of "Count_15" (with out filter) in the built up of step sum aspect.

Next one covers 2004-16 with Step Sum (Daily basis) & MSS (Monthly Step Sum)